The reporting of leasing transactions of a company has often received attention from the SEC and stockholders equally. Since they form one of the largest items of off-balance sheet accounting, reporting of leasing transactions needed a more faithful representation of an organizations leasing activities. In February 2016, the FASB came out with an Accounting Standard Update (ASU) regarding the treatment of lease transactions. This ASU influences all the business entities that lease assets such as real estate, airplanes, and manufacturing equipment. This will majorly impact those lessees whose operating lease transactions are of significant value since these will now need to be accounted for within the balance sheet.

What is an Operating Lease?

An operating lease is a contract that allows for the use of an asset but does not convey rights of ownership of the asset. An operating lease is not capitalized; it is accounted for as a rental expense in what is known as off-balance sheet financing. For the lessor, the asset being leased is accounted for as an asset and is depreciated as such. Operating leases have tax incentives and do not result in assets or liabilities being recorded on the lessee’s balance sheet, which can improve the lessee’s financial ratios.

Source: Investopedia

What is the FASB’s New Update on Lease Transactions?

As per the new Accounting Standard Update (ASU) on leases, operating lease obligations will no longer be an off-balance sheet item and the lessee will have to recognize the assets and liabilities related to operating leases having lease terms of more than 12 months within the balance sheet itself. The ASU on leases will take effect on December 15, 2018, for a public business entities, specific not-for-profit entities, and employee benefit plans that file their statements with SEC.

For all other entities, the amendments in this update are effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020.

Though the earliest impact of this new ASU could be 3 years away, it will be interesting to gauge the effect on companies as lease obligations are usually spread over several years. We ran the existing operating leases in the S&P 100 companies through our Data Analytics Platform and found some interesting results.

Sector-wise Segregation of Operating Lease for S&P 100

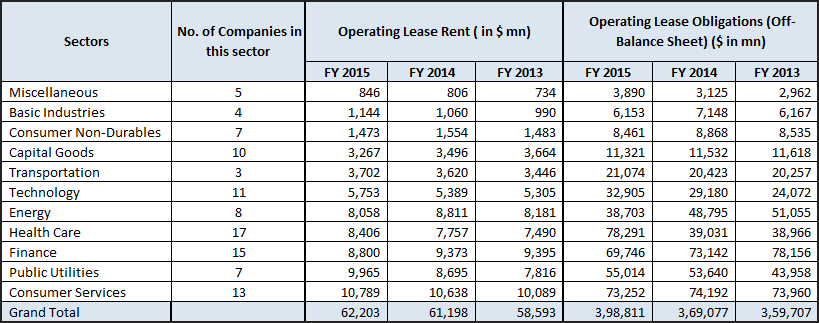

99 of the S&P 100 companies have operating leases and related off-balance sheet obligations reported in their annual reports. Noticeably, the total rental expense incurred in FY 2015 by the S&P 100 was around $62 billion while the off-balance sheet obligations for the same period were around $400 billion. The sector-wise figures for the operating lease rental expenses and the total off-balance sheet obligation against these operating leases for the S&P 100 companies are given below:

Figure 1: Sector-wise segregation of Operating Lease Rent and Operating Lease Obligations of S&P 100 Companies for the past 3 years

To understand how significant these operating lease obligations are, we decided to compare the current years operating lease amount (expense) against the current years operating income. We also compared the future obligations against the firm’s retained earnings to understand if this off-balance sheet liability was adequately covered by the retained earnings.

1. Studying Operating Lease Rent against Operating Income

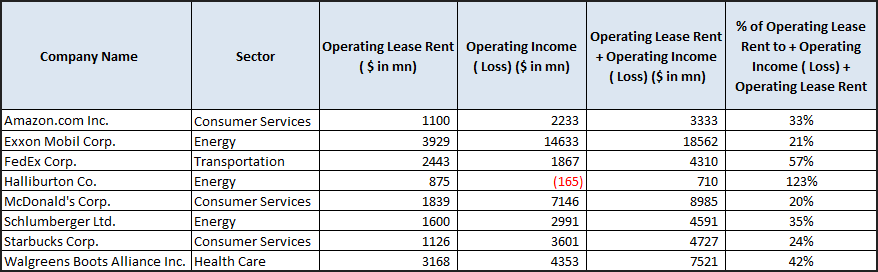

Out of 100, 11 are banking companies hence no operating income has been reported for them. 74 companies have operating lease rent less than 10% of the operating income (Loss) and rent clubbed together, 7 falls under the 10% – 20% category while the remaining 8 companies have a percentage greater than 20. Lets look at companies that had rent expenses of more than 20% of operating income (loss) before providing for the lease expense (FY 2015):

Figure 2: S&P 100 with Operating Lease Rent more than 20% of Operating Income (loss) before providing for the lease expense (FY2015)

The table has three companies from the energy sector, three from consumer services, one from transportation, and one from health care. Except for Halliburton Co, the percentage of operating lease amount (expense) against the operating income for all the companies lies between 20-60%.

2. Studying Operating Lease Obligations against Retained Earning

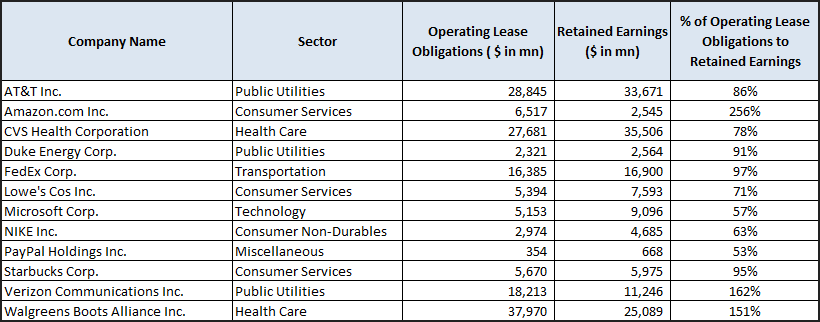

With the new ASU in effect, as the operating lease obligation shows up on the balance sheet, it will require companies to account for the depreciation and interest expense associated with the underlying asset. This in turn will cause lower net income resulting in lower retained earnings for the reporting entities.

To gauge the effect of this revised accounting practice, we studied the operating lease obligations against retained earnings for the S&P 100. Here as well we sorted the companies into 3 groups; while 70 companies have operating lease obligations of less than 10 % of their retained earnings, 18 have numbers between 10 and 20%, and 12 falls in the red zone with percentages greater than 50%. Lets look at the list of those twelve companies whose operating lease obligations are more than 50% of their retained earnings for FY 2015:

Figure 3: S&P 100 with Operating Lease Obligations more than 50% of their retained earnings for FY 2015

This table reveals that such companies are mostly from public utilities, consumer services, and healthcare sectors.

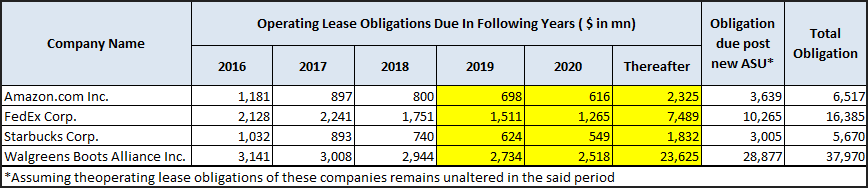

An interesting commonality between the two tables above is four companies whose lease rent expense is more than 20% of operating income (loss), adjusted for lease rent expense, and whose operating lease obligations are more than 50% of their retained earnings. The companies are Amazon inc, FedEx, Starbucks Corp, and Walgreens Boots Alliance Inc. To find out the coverage of obligations further, we studied the payment schedule of the future obligations of these companies.

Figure 4: Payment Schedule of companies with Operating Lease Rent more than 20% of Operating Income (loss) before providing for the lease expense and Operating Lease Obligations more than 50% of their retained earnings for FY 2015

Conclusion

The new ASU could result in certain financial ratios such as Asset Turnover, Return on Capital Employed, Return on Asset, and Net Worth, which are dependent on asset levels in the balance sheet, getting adversely affected. It could also have an impact on bank lending covenants. All this, in turn, could also influence the leasing versus buying decision for these companies.

With over 2 years left before the earliest implementation date, we will have to wait and see how many of these companies continue to use operating lease transactions as a preferred mode of financing their assets.